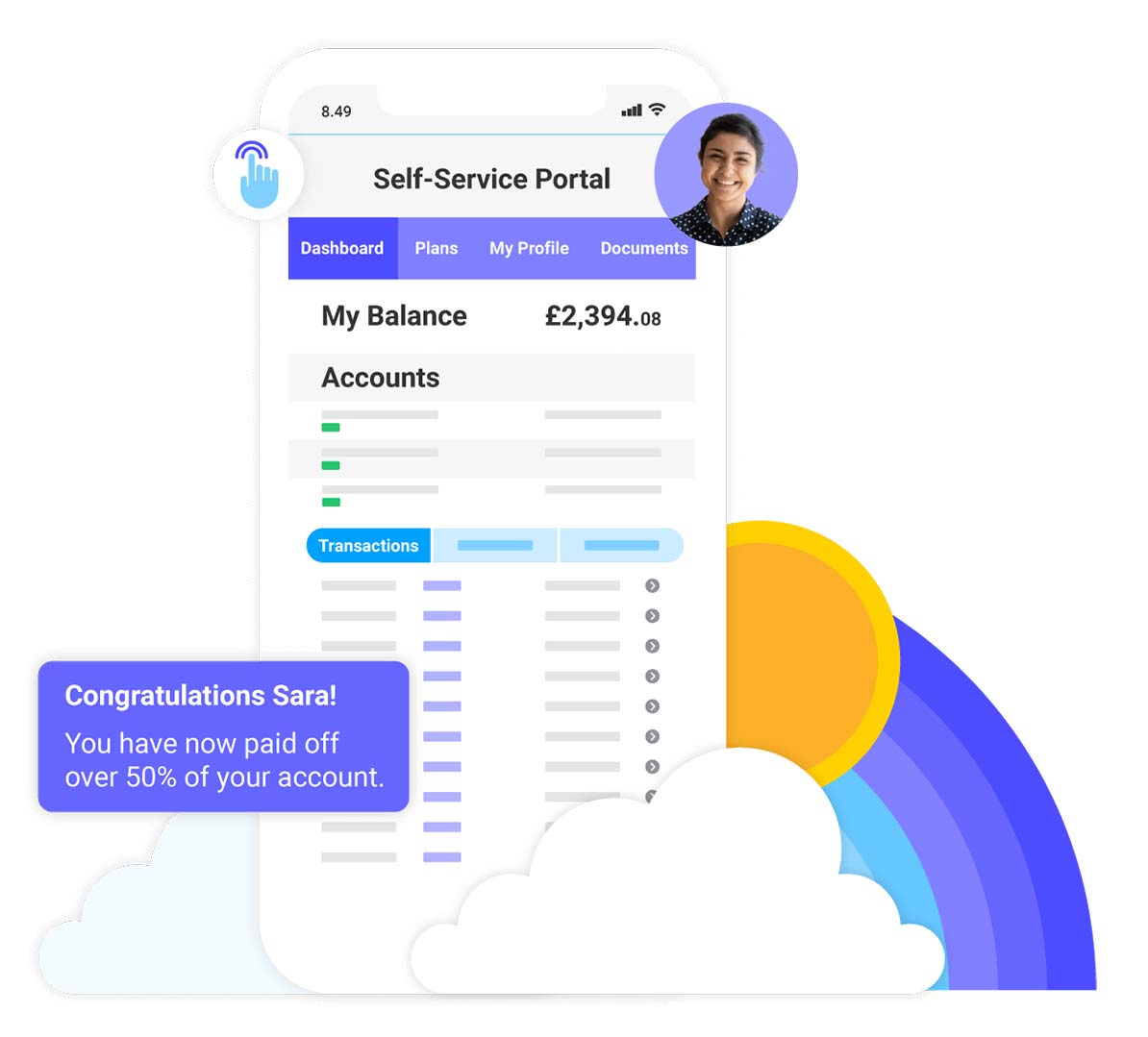

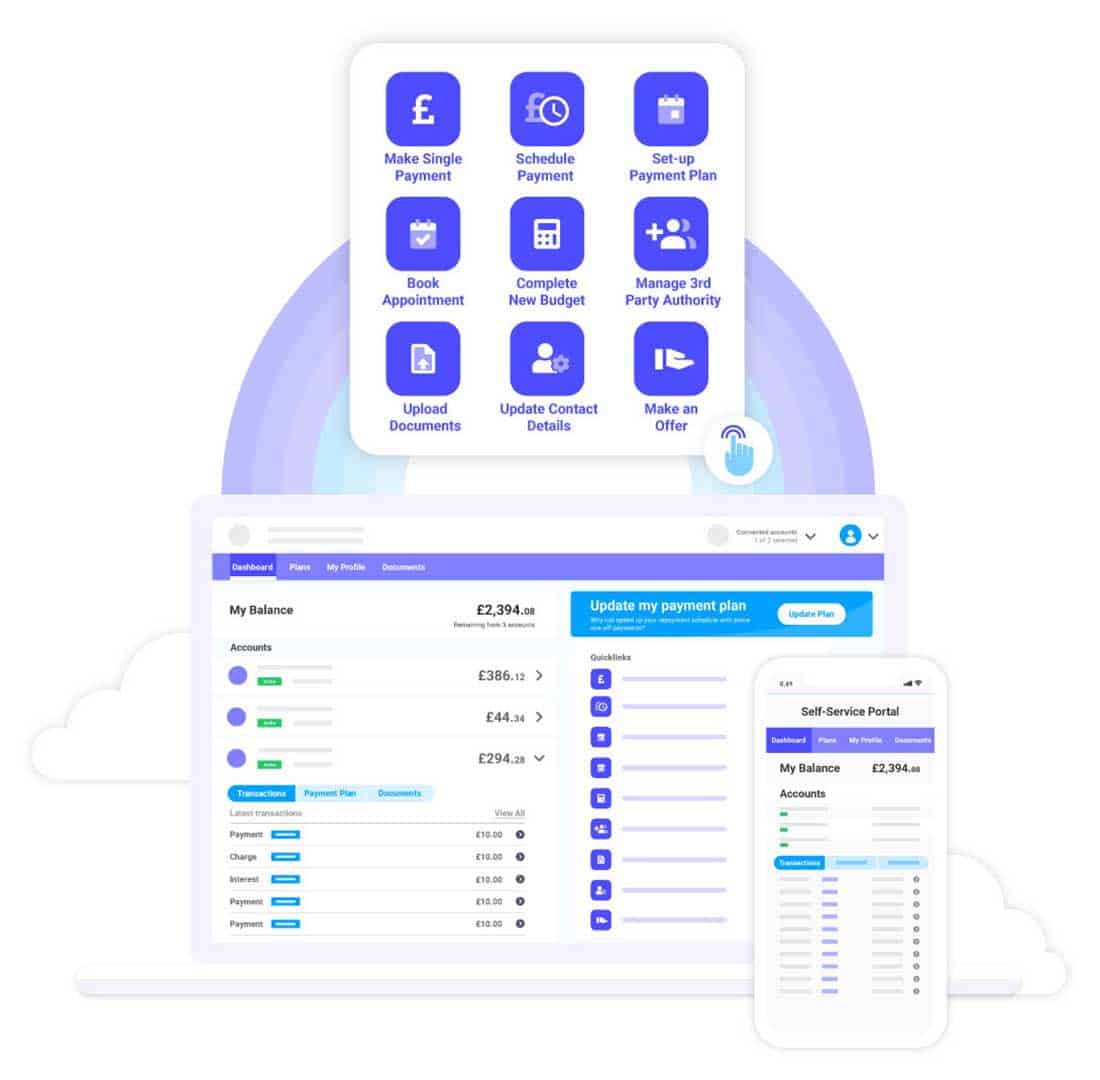

Empower Your Customers With Self-Service

Create positive customers experiences with our powerful self-service portal. Your customers can easily access account information, manage their personal information, and securely make payments from any device, at a time that suits them.

Customer Portal

Try it here

Engage

Create, track and launch communication funnels to stay engaged with customers.

View

Enable customers to access all the information they need to manage their accounts.

Manage

Make managing accounts simple, quick and convenient for your customers.

Pay

Provide secure, compliant and convenient payment options that your customers want.

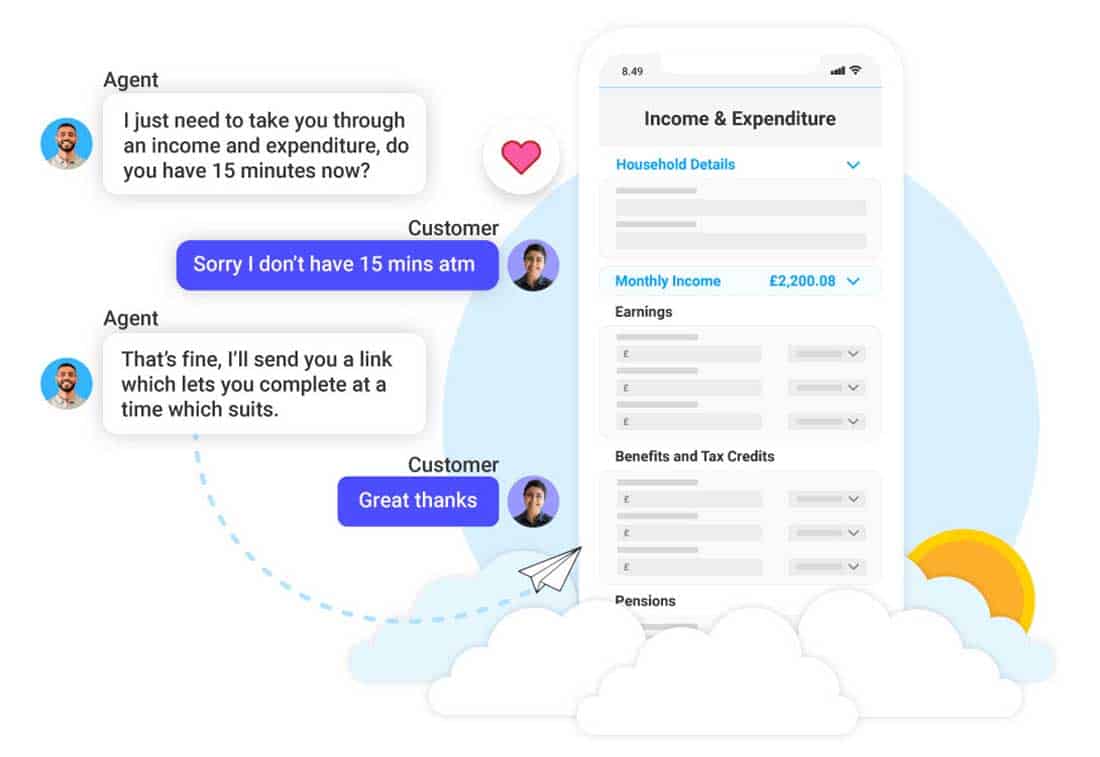

Fast, convenient and helpful communication, delivers results

Simplify customer interactions and create positive experiences by sending QuickLinks. Enable customers to complete forms and provide information at their convenience. No more delays or unnecessary callbacks.

Mobile first

Customers can manage their self-service portal from any device. Whether they are on the go, or at home, they can access their account with ease, at a time that suits them.

Effortless Payment Management

Send payment links for speed and convenience. Track delivery, open and acceptance rates whether requesting payments, offering bespoke settlements or payment plans.

Chat

Transform customer engagement by integrating our chat functionality into your portal for faster query resolution, reducing calls and enhancing customer service.

Give customers the information and options they want from self-serve

With over 75% of customers preferring digital self-service, don’t limit them to making payments and viewing balances. Expand these capabilities to empower your customers with the autonomy to fulfil their all of their requests conveniently.

Account Information

Eliminate the need for customers having to make a call to every time they want to ask for their account information. Make their life easier by providing access via your customer portal.

Documentation

Define and control what documents your customers have access to, and enable hassle-free document uploads for enhanced interaction.

A Single View

Give customers a unified login to view all their accounts and streamline information updates in one convenient location.

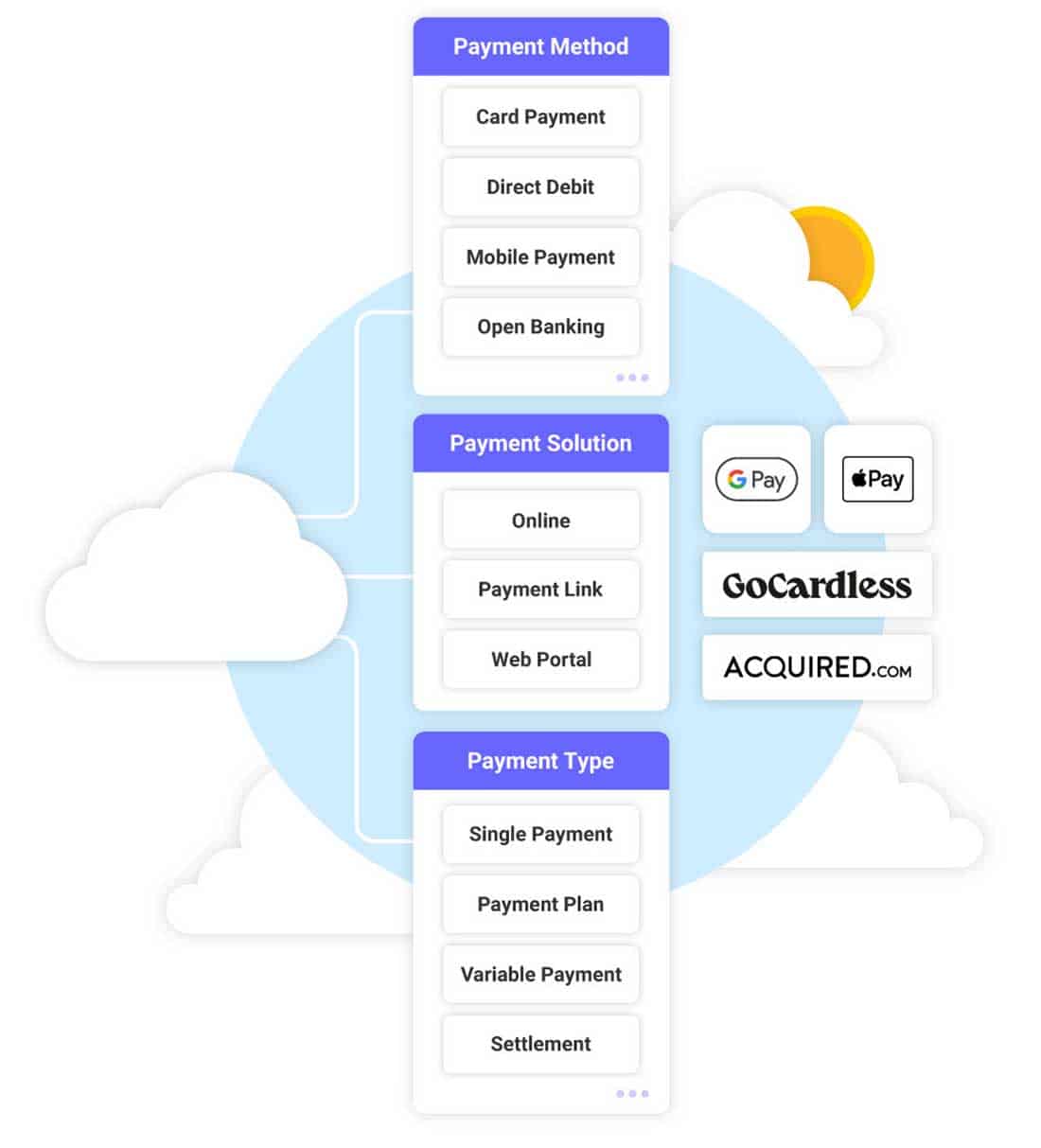

A powerful payment solution giving customers options and businesses control

Your relationship with a customer often extends beyond a single payment or payment plan. Whether a customer wants to change payment method, settle their account or update their payment amount or frequency due to life circumstances, Financial Cloud’s Customer Portal gives you them flexibility to easily manage payments. Fully automated and scalable, Financial Cloud provides a central payment solution that seamlessly tracks and processes all payments efficiently, all whilst maintaining comprehensive logs and ensuring auditability.

Any method, anytime, at scale

From card payments to direct debits and open banking, our automated payment solution effortlessly handles these processes at scale.

Guarantee affordability

Ensure customer affordability when setting up new payment plans with our built-in I&E flows for checking disposable income.

Flexible and configurable

Take control of payment processing, set the time for bulk processing and define minimum payment thresholds.

A platform built for financial services

What would you like to manage with Financial Cloud?

Every lender needs a FinTech Partner

More than 70% of business and technology banking professionals reported recently that their company would maintain or increase investment in banking, lending, and digital engagement platforms…

Read More

Modernising debt collection in 2023 and beyond

Mid-pandemic it was clear that a debt crisis was coming and that leaders in collections should brace their businesses for difficult times ahead. Nobody however could…

Read More

Ten benefits of cloud CRM for lending and collections

Despite record investment in digital transformation in FSI in the past five years, many financial organisations are still over-reliant on legacy customer contact systems and disparate…

Read MoreDiscover the power of Financial Cloud CRM

Financial Cloud is a customer relationship management platform for building a better financial experience for customers. It’s one integrated CRM platform with a single, shared view of every customer.