24×7 Secure Dynamic IVR Payments

Offer fully-automated payment experiences to your customers with a branded telephony payment solution that enables your business to process payments whenever your customers want.

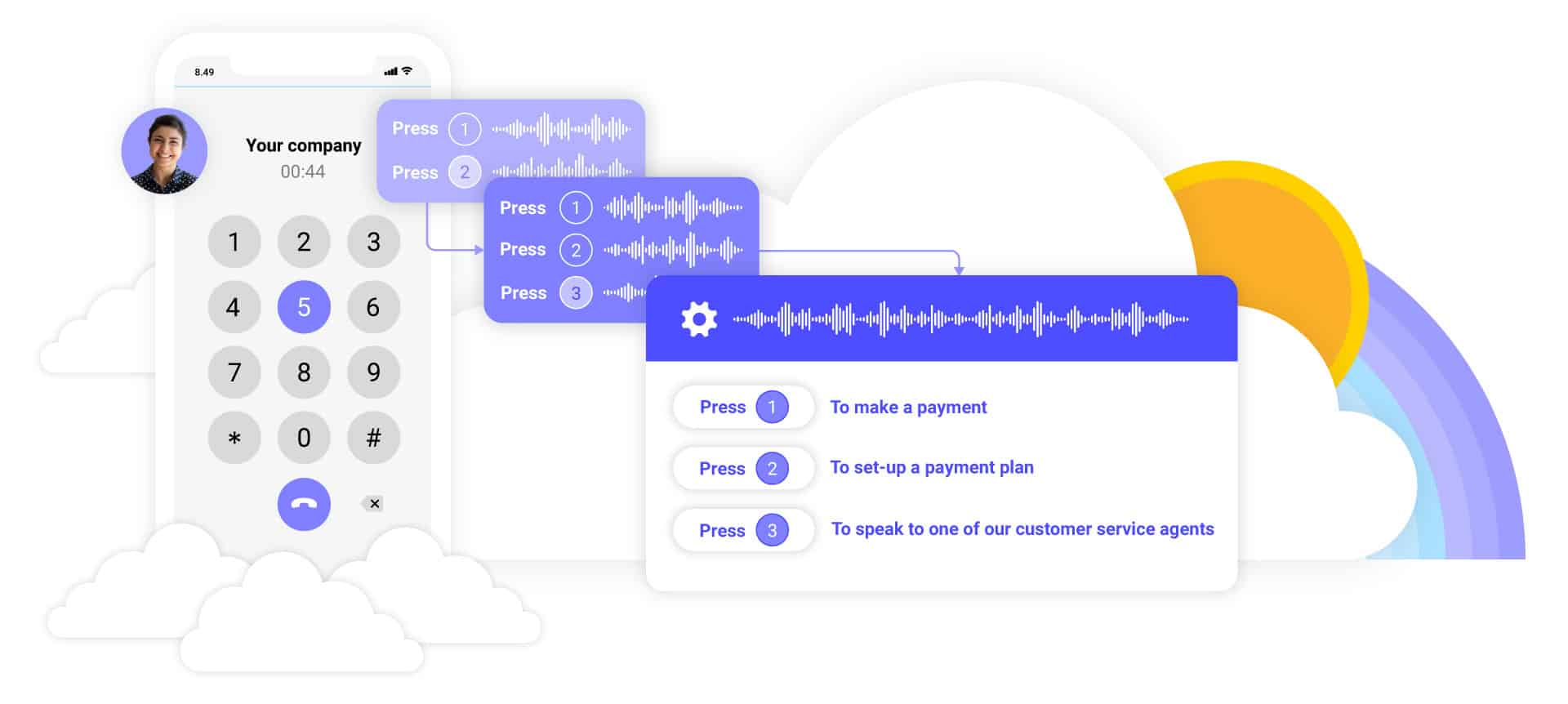

Self-Service Dynamic Payment IVR

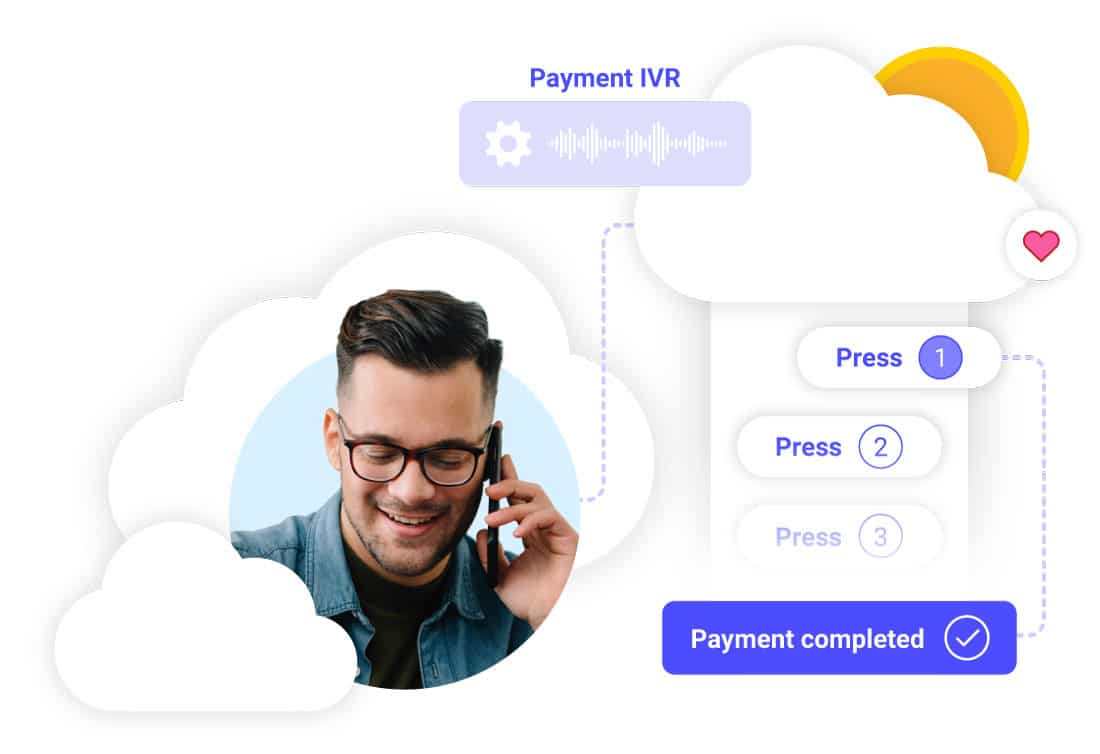

Customer interactions shouldn’t be limited to normal working hours, some people might want to make a payment at 3 am on a Sunday morning –and they should be able to. By providing our Payment IVR solution you can ensure you’re available to our customers at a time that suits them.

“We’ve found that most customers who want to just make a quick payment would often rather just make a payment themselves on a Payment IVR than wait in a queue to chat with somebody to do the exact same task. ”

Craig

Customer Success Manager

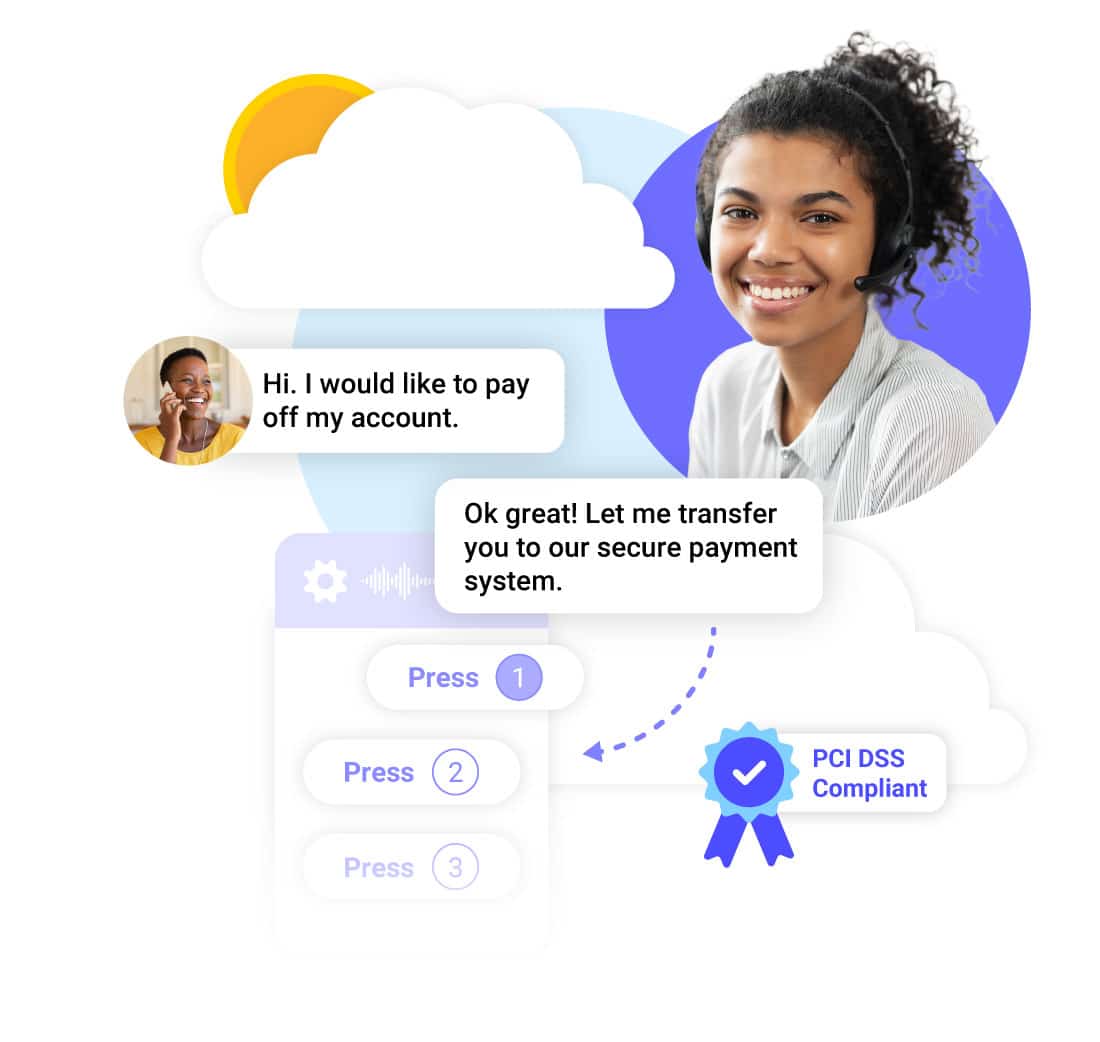

Hand-Off Payment IVR

Provide a secure and compliant payment solution which reduces the scope of your organisation’s PCI requirements and reduces staff workload.

Payment IVR Benefits

Secure Payment Experience

Your business can rely on our secure payment IVR system to deliver a fully PCI compliant solution.

Customisable Voice

With text-to-speech technology customise your IVR to provide a branded experience to your customers.

Improved Conversion Rates

Offer customers the choice of fully automated IVR payments, improving your conversion rates with an efficient customer payment process.

A platform built for financial services

What would you like to manage with Financial Cloud?

Every lender needs a FinTech Partner

More than 70% of business and technology banking professionals reported recently that their company would maintain or increase investment in banking, lending, and digital engagement platforms…

Read More

Modernising debt collection in 2023 and beyond

Mid-pandemic it was clear that a debt crisis was coming and that leaders in collections should brace their businesses for difficult times ahead. Nobody however could…

Read More

Ten benefits of cloud CRM for lending and collections

Despite record investment in digital transformation in FSI in the past five years, many financial organisations are still over-reliant on legacy customer contact systems and disparate…

Read MoreDiscover the power of Financial Cloud CRM

Financial Cloud is a customer relationship management platform for building a better financial experience for customers. It’s one integrated CRM platform with a single, shared view of every customer.